The Wall Street Report January 2023

January 2023 was the best start to a year since 1987 in the Markets, and top 5 since 1929.

Read this month's issue of the Wall Street Report to obtain a summary on the stock market performance in January, including Economic Data and Fixed Income Overview.

January 2023 was the best start to a year since 1987 in the Markets, and top 5 since 1929.

January 2023 was the best start to a year since 1987 in the Markets, and top 5 since 1929. Read this month's issue of the Wall Street Report to obtain a summary on the stock market performance in January, including Economic Data and Fixed Income Overview.

How did the Markets perform in January 2023? What did investors and traders experience during the first month of the New Year? If you were out of the Markets at this time, chances are you missed out on strong bullish momentum across most asset classes. Let's dive in.

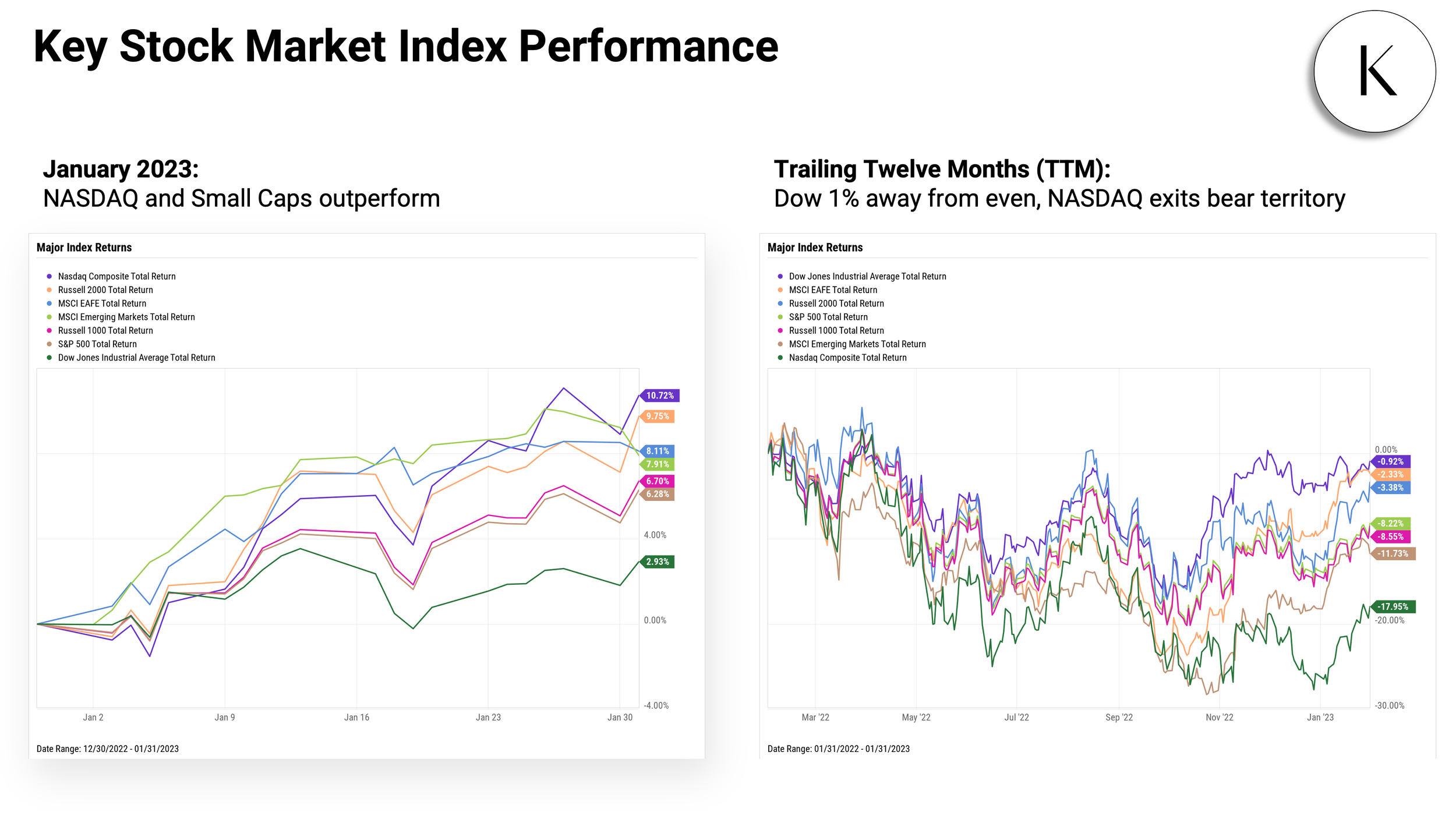

January Returns: S&P 500: 6.3%, Nasdaq: 10.7%, Dow Jones: 2.9%, Russell 2000: 9.8%, Russell 1000: 6.7%, Developed Markets: +8.1%, Emerging Markets: 7.9%.

January Performance:

Small-Cap Growth 1-Month: 10.0%

Small-Cap Value 1-Month: 9.7%

Large-Cap Growth 1-Month: 8.3%

Large-Cap Value 1-Month: 5.1%

TTM:

Large-Cap Value TTM: -0.6%

Small-Cap Value TTM: -0.7%

Small-Cap Growth TTM: -6.3%

Large-Cap Growth TTM: -16.1%

January Returns: Consumer Discretionary: 15.1%, Communication Services: 14.8%, Real Estate: 9.9%, Technology: 9.3%, Materials: 9.0%, Financials: 6.9%, Industrials: 3.7%, Energy: 2.8%.

January Returns:

Warner Bros.Discovery (WBD): 56.3%, Tesla (TSLA): 40.6%, Western Digital (WDC): 39.3%, Paramount Global (PARA): 37.2%, Carnival Corp (CCL): 34.2%, NVIDIA (NVDA): 33.7%, SVB Financial Group (SIVB): 31.4%, Royal Caribbean Group (RCL): 31.4%, Expedia Group (EXPE): 30.5%, MarketAxess Holdings (MKTX): 30.5%.

January Returns:

Northrop Grumman (NOC): -17.9%, Enphase Energy (ENPH): -16.4%, Pfizer (PFE): -13.8%, Archer-Daniels Midland (ADM): -10.8%, NextEra Energy (NEE): -10.7%, Baxter International (BAX): -10.4%, McCormick & Co (MKC): -9.4%, AbbVie (ABBV): -8.6%, Campbell Soup Co (CPB): -8.5%, Johnson & Johnson (JNJ): -7.5%.

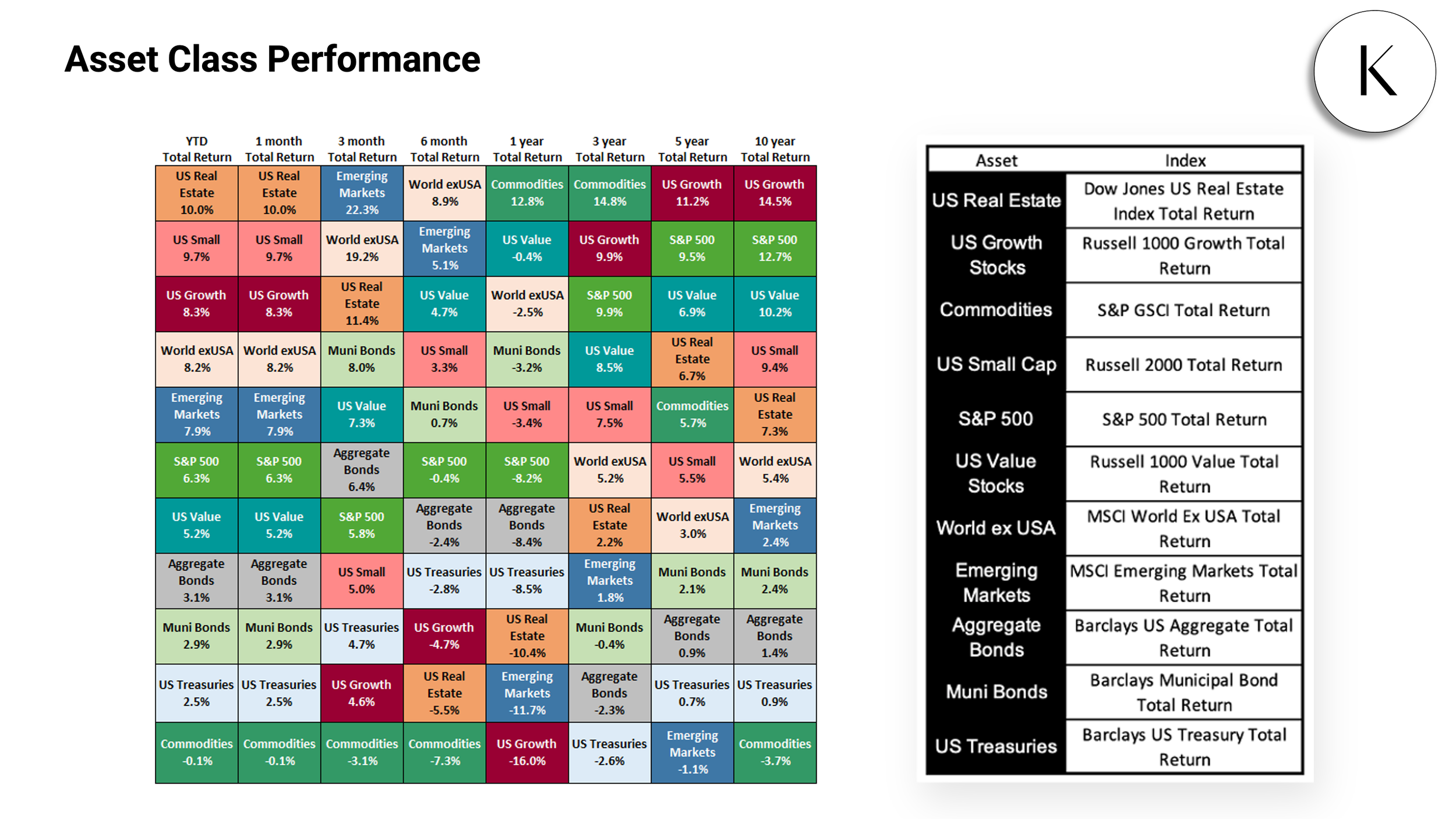

Real Estate’s 10.0% gain made it the best-performing asset class in January, followed by US Small Caps in a close second at 9.7%. The only asset class to finish January in the red was Commodities, which was also negative throughout the second half of 2022 but up 12.8% over the past twelve months.

Inflation slowed for the sixth straight month to 6.45% YoY, and core inflation fell a quarter of a percentage point as well. The gap between new and existing home sales widened—US New Single-Family Home Sales MoM grew for the third straight month, but Existing Home Sales contracted 1.5%, marking its 11th consecutive monthly fall. The median national existing home price also declined 1.5%. In the world of crypto, Bitcoin and Ethereum each soared well over 30% last month, marking quite a turnaround from last year when both cryptocurrencies plummeted around 65%.

Employment numbers are still showing overall improvement with Unemployment down to 3.5% and Labor Force Participation Rate increased to 62.3%.

US Inflation cooled down for the sixth straight month, falling 0.66 percentage points to 6.45%. YoY US Core Inflation dipped a quarter of a percentage point to 5.71%. The Federal Reserve raised the Upper Limit Target Federal Funds Rate by 25 points to 4.75% at its February 1st meeting, the first rate hike of just 25 bps since March 2022.

The US ISM Manufacturing PMI fell deeper into contraction territory in January. At 47.4, January’s reading marks the eighth consecutive monthly decline for the indicator, and also its lowest reading since May 2020.

MoM US New Single-Family Home Sales increased 2.3% in December, three months removed from a plummet of nearly 15%.

Existing housing data wasn’t as cheerful, however—MoM US Existing Home Sales declined 1.5% in December, marking the 11th consecutive negative month for existing home sales. Slower sales once again translated into lower home prices; the Median Sales Price of Existing Homes also declined by 1.5% to $366,900, falling for a sixth straight month.

Bitcoin and Ethereum each tumbled around 65% last year. However, Bitcoin surged 37.2% in January and Ethereum jumped 30.6%. Is this a signal that the worst is over for crypto, or just another hill on the crypto-coaster?

Yields on longer-term treasuries fell while those with short-term maturities rose. The 5-Year, 10-Year, and 20-Year rates all declined by 36 basis points. On the flip side, yields on the 1-Month, 3-Month, and 6-Month Treasury Bills increased in January. The 1-Month saw the largest increase across the yield curve, at 46 basis points. Globally, Japan’s 10 Year Government Bond Interest Rate increased by six basis points.

Yields on longer-term treasuries fell while those with shorter-term maturities rose. The 5-Year, 10-Year, and 20-Year all declined by 36 basis points.

On the flip side, yields on the 1-Month, 3-Month, and 6-Month Treasury Bills increased in January. The 1-Month saw the largest increase across the yield curve, at 46 basis points.

Japan’s 10 Year Government Bond Interest Rate was the only long-term fixed income instrument to log an increase on this chart (6 bps).

Corporate bond yields declined across the board in January, with lower-grade BBB logging the largest decrease at 41 basis points.

Thank you for reading the January 2023 issue of "The Wall Street Report".

Subscribe to this monthly report: https://www.konstandinovic.com/newsletter

Q4 Economic Summary

Konstandinovic Management Economic Analysis Summary and Update for Q4 2022.

US Stocks turned around in Q4 after falling for the first three quarters of 2022.

Ten of the eleven S&P Sectors had positive returns in Q4 of 2022.

US Stocks turned around in Q4 after falling for the first three quarters of 2022. The Nasdaq Composite continued in the red but was near flat for the quarter. The Dow Jones Industrial Average rebounded the most, posting a quarterly return of 16.01%. Global markets had similar returns, with the MSCI EAFE Total Return index returning 17.4% in Q4.

Ten of the eleven S&P Sectors had positive returns in Q4 of 2022. The Energy and Industrial sectors led the way with 22.7% and 19.12% returns, respectively. Consumer Discretionary was the only sector in the red, posting a -9.08% return for the quarter.

This table shows the performance of asset classes over different time frames.

World ex USA was the best performer in Q4, returning 16.3%. Domestically, US Value outperformed with a return of 12.4%, finishing the year behind the best—and only positive—performer of 2022: Commodities.

This visual shows historical quarterly asset class performance for the last 15 quarters.

All asset classes had positive returns in Q4. World ex USA led the way with a 16.3% return. US Treasuries fell back to the bottom of the pack, returning a mere 0.7%.

This slide points out various risk vs. return strategies, including stock to bond allocations of 80/20, 50/50, 20/80, and 100/0 (S&P 500). All four strategies had positive returns in Q4 2022 but ended negative on the year. The 20/80 allocation remains the relative outperformer over the previous year, down -11.61%.

This visual demonstrates the value that diversification can provide investors during turbulent periods—for both the stock and bond market.

The fourth quarter of 2022 brought more action in the yield curve. Treasury Rates continue to rise across the board with the exception of the 5-Year, and by so much in the short-end that the yield curve remains flattened past the point of inversion.

The 1-Year Treasury Rate ended Q4 at 4.73%, greater than both the 10-Year Rate’s 3.88% yield and the 30-Year’s 3.97%. The 10-2 Spread was inverted at the end of the quarter, with a differential of -0.53%.

This table is a heatmap of various economic data points which are considered leading indicators and shows their trends over time. The first four columns show a quarter-by-quarter change, whereas the following 12 columns show annual changes in the data. The 10-2 Year Treasury Yield has continued to drop, reaching levels that it hasn’t fallen to in 40+ years. The Philly Fed Manufacturing Activity Index and the NY Fed Current Business Activity Index both ended the year below zero, which was last seen during the 2020 Coronavirus pandemic. The S&P 500 logged its only positive quarter in Q4.

This image shows the trade activity between the USA and other key partners through September 30th, 2022. The chart on the left shows that US Imports have declined off their high, now below $1.0T per quarter. US Exports increased ever so slightly. The chart on the right shows the divergence of trade imports versus exports bouncing off its lowest US Trade Balance ever recorded in Q1 2022. The table below shows how imports have increased YoY in all regions. At the end of Q3 2022, Services Imports increased the most YoY in China at 33%. Goods Exports climbed the highest in the EU YoY, at 32%.

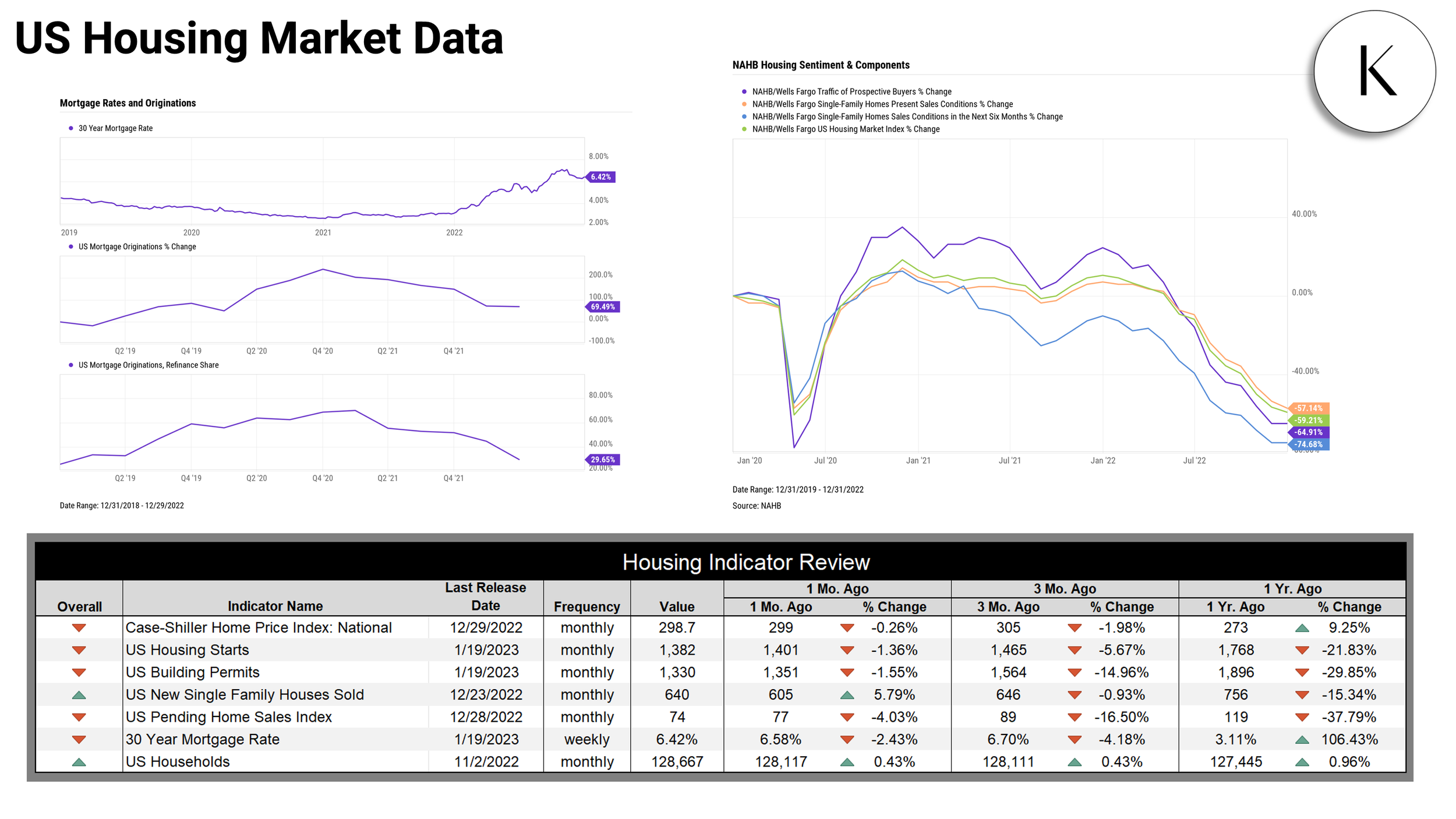

2021 brought with it the lowest 30 Year mortgage rate in decades. Since then, mortgage rates have shot higher—the 30-Year rate ended Q4 at 6.42%, causing mortgage originations to decline. Both the current and near-term outlooks for home sales continued to fall in Q4, according to data from the National Association of Home Builders (NAHB) and Wells Fargo.

The US Dollar to Euro, to Pound Sterling, to Chinese Yuan and to Japanese Yen exchange rates all fell from their 52-week highs in Q4 2022. All four rates are back down closer to their one-year averages.

The S&P 500 CAPE Ratio hit a 20-year high towards the end of 2021. Since then, a sharp decline has seen it regress towards its average over that time period, but at 28.39 is still two points above its 20-year average.

73% of the S&P 500 ended the year in the red for 2022. The chart above displays the amount of market cap lost by those losing companies in each sector. No Energy Sector stocks lost market cap in 2022, all ended the year positive.

The 60/40 Portfolio experienced its second worst calendar year returns since 1997, ending at -15.91%.

A strong majority of S&P 500 companies (~83%) had a positive Q4 return. However, that wasn’t enough to pull most constituents out of the hole on the year. Of those Q4 winners, only one third had a positive 2022. Tesla ($TSLA) had the worst Q4 performance, falling more than 50% in the quarter alone. Occidental Petroleum Corp ($OXY) performed best in 2022, rising 119%.

2022 saw some big names cool off from previous rallies. Megacap stocks lost tremendous amounts of market cap—Apple (AAPL), Microsoft (MSFT), Alphabet (GOOG, GOOGL) and Amazon (AMZN) shrank by a combined $3.177T in 2022.

Value investors, while still down for the year, stomached much lighter losses than their Growth equivalents in a year of high inflation.

Cryptocurrencies continued to fall throughout 2022, putting major coins 60-80% off their highs.

Hope you enjoyed the Q4 2022 Economic and Market Summary!

Thank you for reading.